Amazon Tax-Free Address

See instructions below on how to add your Global Edge 360 Tax-Free Address on your Amazon account.

1. Open Amazon Account

Sign into your Amazon account using amazon.com or the Amazon app.

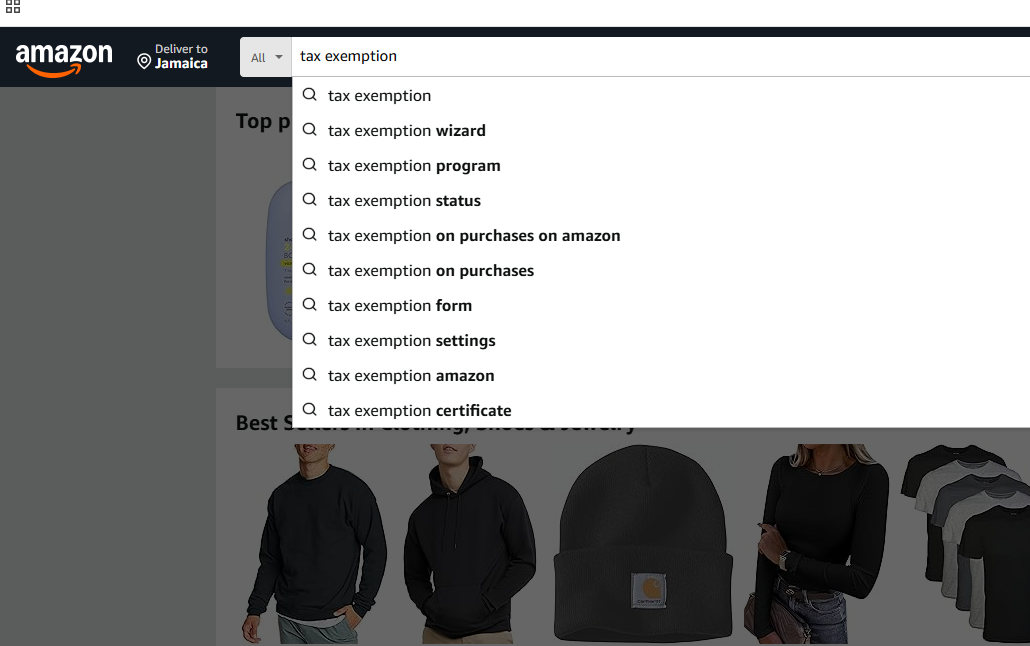

2. Go to search bar on Amazon

From the search bar on your Amazon account, type "Amazon Tax Exemption"

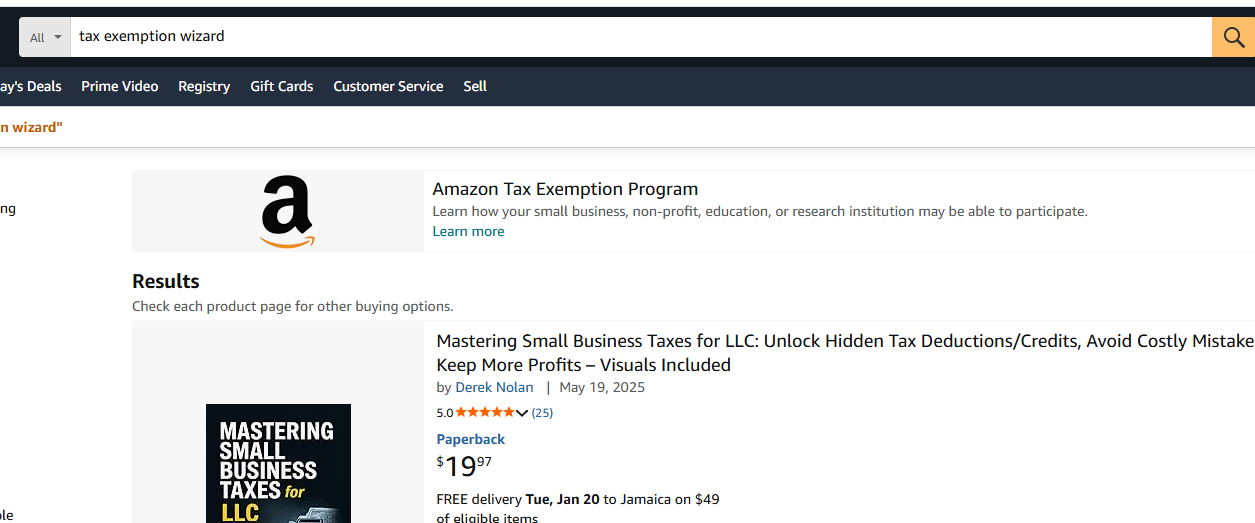

3. Select "Amazon Tax Exemption Program"

Select the first option with the Amazon Logo

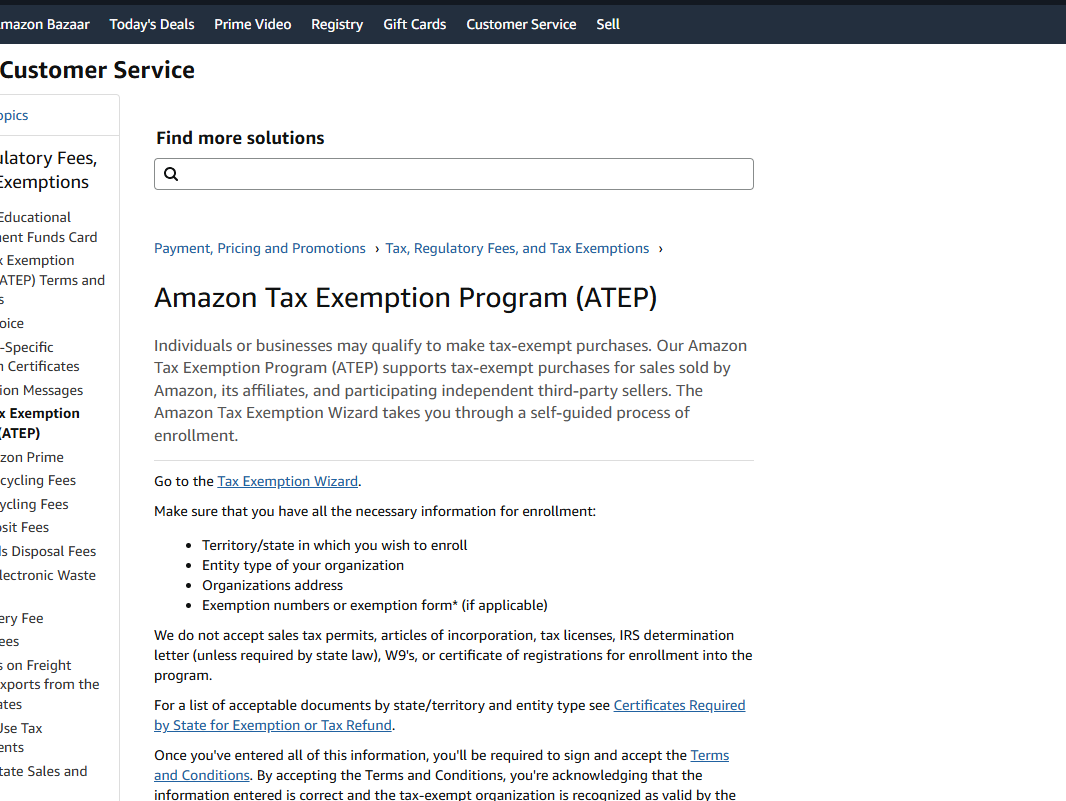

4. Select "Amazon Tax Exemption"

Select the Hyper Link with the words "Tax Exemption Wizard"

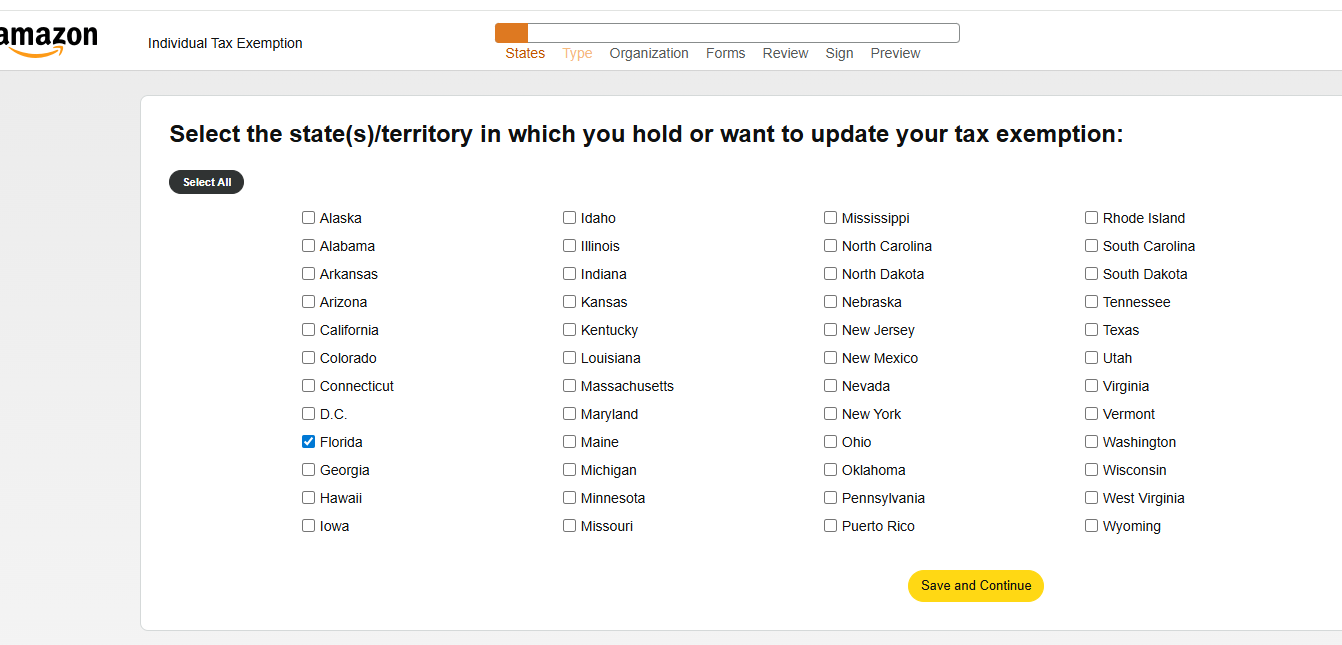

5. Select "Florida"

From the list of States, Select "Florida" press save and continue.

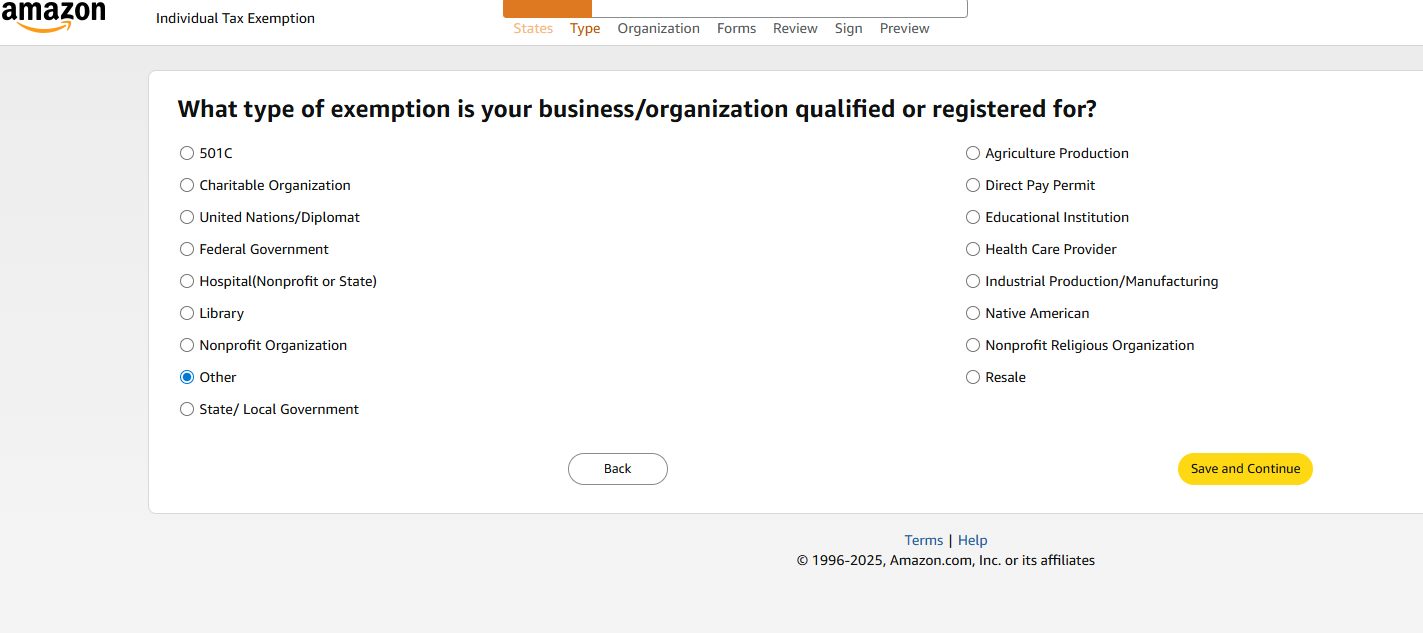

6. Select "Other"

Select “OTHER” as the organization body

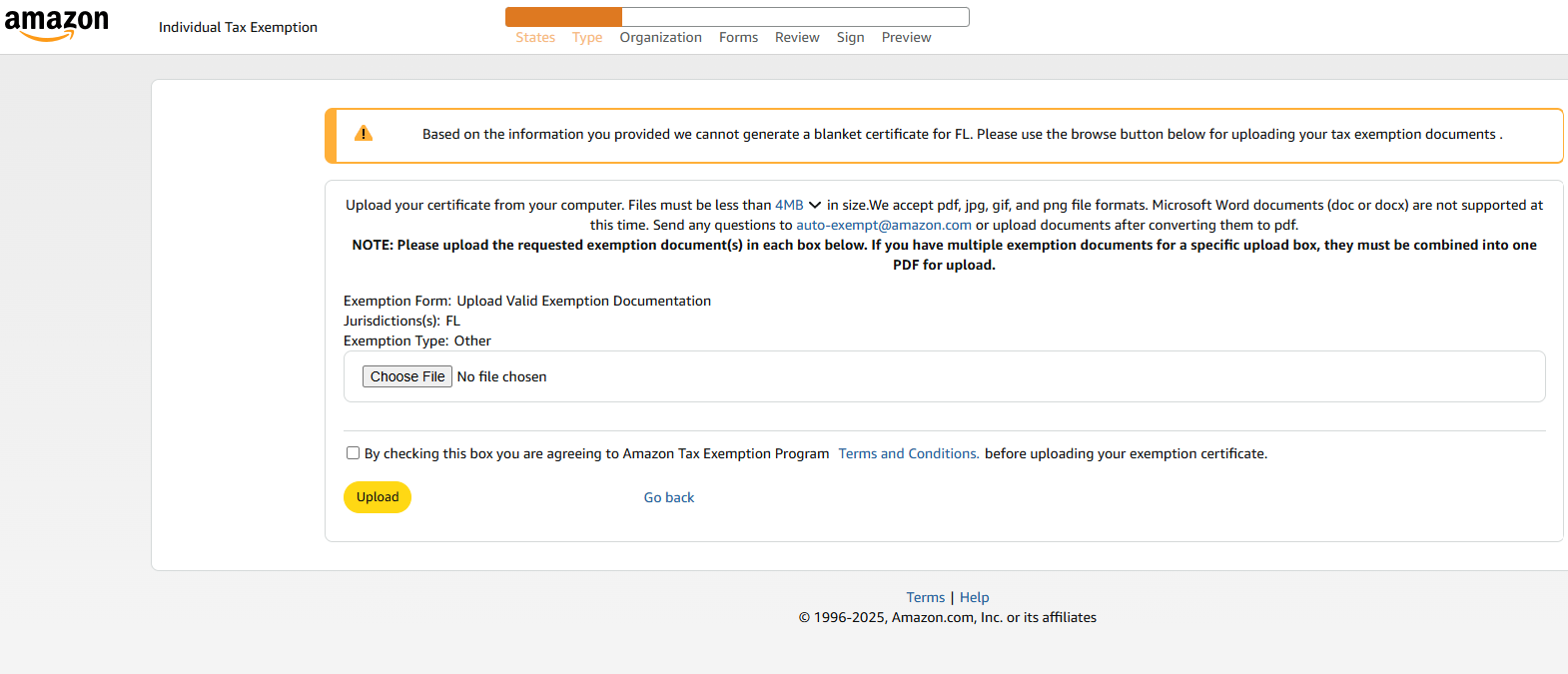

7. Upload the Tax Exemption Certificate from your device

Choose file from your device, click the terms and condition button and then select upload.

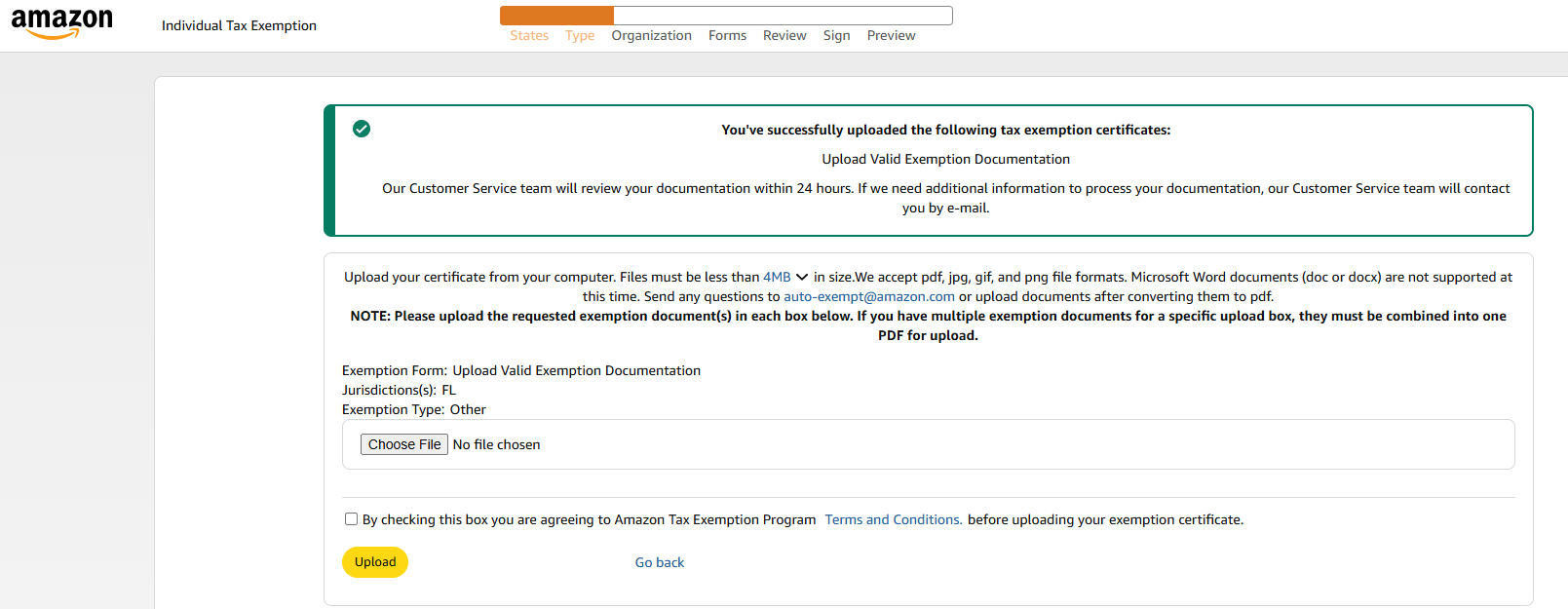

8. After Uploading certificate

From here, wait for confirmation Email from Amazon.